CapitaTrail

Focus Your Vision • Magnify Your Returns • Crystal Clear Insights

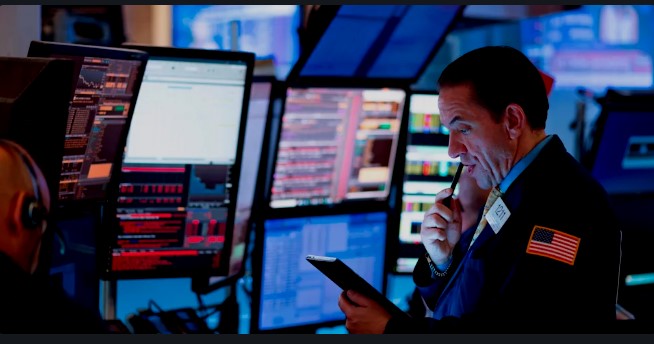

Dow 30

49625.97

+230.8 (+0.47%)

Nasdaq

22886.07

+203.34 (+0.9%)

S&P 500

6909.51

+47.62 (+0.69%)

Latest News

Airbus SE (OTC:EADSY) Maintains "Hold" Rating Amidst Aerospace Developments

2026-02-20

Alex Lavoie

OTC:EADSY

Clean Harbors Inc. (NYSE: CLH) Insider Trading and Financial Performance

2026-02-20

Andrew Wynn

NYSE:CLH

Understanding the Investment Potential of Savers Value Village Inc (SVV)

2026-02-20

Stuart Mooney

NYSE:SVV

TechnipFMC (NYSE:FTI) Gains Momentum with Strong Analyst Ratings and Price Movement

2026-02-20

Andrew Wynn

NYSE:FTI

CME Group Director Sells Shares Amidst Company's Strategic Moves

2026-02-20

Danny Green

NASDAQ:CME

DNOW Inc. Financial Overview: A Mixed Picture Amid Challenges

2026-02-20

Danny Green

NYSE:DNOW

iRhythm Technologies, Inc. (NASDAQ:IRTC) Sees Positive Outlook from William Blair

2026-02-20

Andrew Wynn

NASDAQ:IRTC

Air Liquide (OTC:AIQUF) Financial Performance Analysis

2026-02-20

Gordon Thompson

OTC:AIQUF

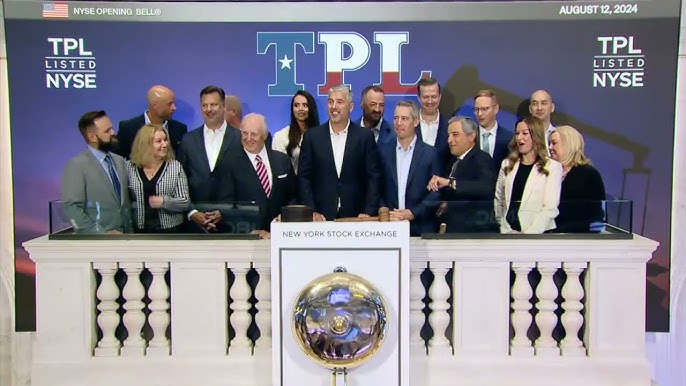

Texas Pacific Land Corporation (NYSE:TPL) Engages Shareholders with an Insightful Visit

2026-02-20

Rayan Ahmad

NYSE:TPL

Sprott Inc. (SII) Maintains "Hold" Rating with Increased Price Target

2026-02-20

Alex Lavoie

NYSE:SII